Enrolling in your company’s benefits is one of the first things you will do as a new attending physician starting your first job. Depending on your job’s healthcare benefits, you may have to decide between a Health Savings Account (HSA) and a Healthcare Flexible Spending Account (FSA). This article will highlight the differences between these two options, as well as provide insights to help new attending physicians make informed decisions that align with their financial goals.

Many people don’t know that Health Savings Accounts (referred to as an HSA for the remainder of the article) and Healthcare Flex Spending Accounts (referred to as an FSA for the remainder of the article) are actually different things. It’s easy to understand why. They have very similar names and abbreviations, and from a high level, they both accomplish similar objectives. Each is used in tandem with your health insurance coverage to allow you to save and pay for out-of-pocket medical expenses on a tax-free basis. While they share these similarities, there are also key differences that separate these two types of accounts.

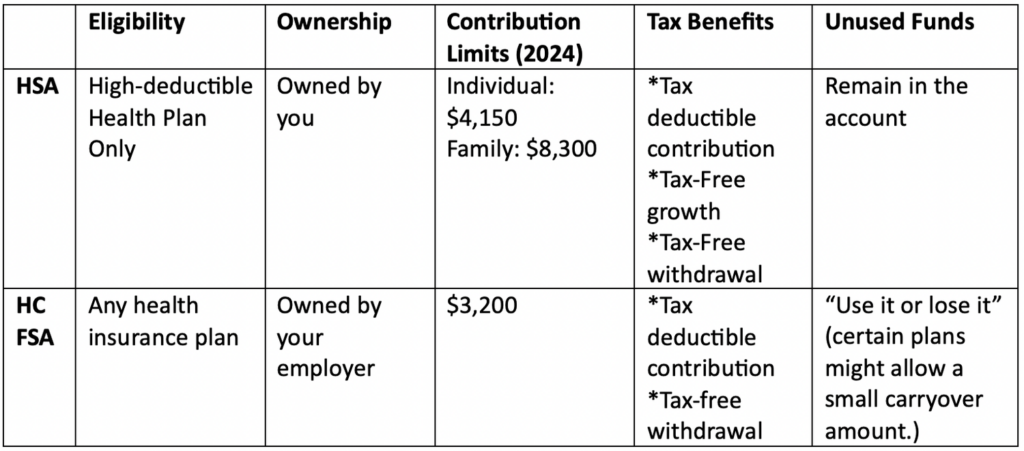

Eligibility

First, in order to be eligible to contribute to an HSA, you must be enrolled in a qualifying High Deductible Health Plan (HDHP). Most of the time, these are the plans that have a higher deductible and out-of-pocket maximum, compared to other health insurance plans. They also tend to have less expensive premiums.

In contrast, Healthcare FSAs do not require you to be enrolled in an HDHP or any specific health insurance plan. As long as your employer offers it as a benefit, you can enroll and participate in a Healthcare FSA.

Ownership of the account

The next major difference is ownership. Your HSA is owned by you. This means if you leave your current job, you maintain control of your HSA and all of the money inside – even the money your employer has contributed. This characteristic ensures that physicians get to keep their HSA and all the money inside of it even amidst career changes. This provides a lot of peace of mind when making contributions to this type of account.

For example, let’s say your first job as an attending physician offers a high-deductible health plan with an HSA, which you contribute to for two years. After your initial contract expires, you decide to change employers, but your new employer doesn’t offer a HDHP with an HSA. Your previous HSA will remain under your control after the job change. You will no longer be able to contribute to the HSA, because you are no longer enrolled in a HDHP, but you will maintain access to all of the funds and control over the investments inside of the account. You might want to roll your HSA over to a different custodian, but you can view that as an opportunity to pick one with no fees and good investment options. Fidelity is a good option, but there are numerous companies to choose from.

On the contrary, Healthcare FSAs are employer-owned. This means that if you change employers, funds in your FSA are not portable and do not go with you to your new job – even if your new employer also offers a Healthcare FSA. So, before you switch jobs, you need to make sure to use the money in your FSA, or you will lose it.

FSA money is designed to be used each year, so any leftover funds at the end can’t be rolled over to the next year, save for a small amount. Your employer’s specific FSA plan probably allows you to roll $500 over to next year (this amount is common), but anything exceeding that amount is lost. Hence the term “use it or lose it.”

Contribution Limits

Contribution limits are another difference between HSAs and FSAs. HSAs have higher contribution limits, as well as offering even higher limits for families. The 2024 contribution limits for HSAs are $4,150 for individuals and $8,300 for families. On the other hand, the Healthcare FSA contribution limit for 2024 is $3,200, with no higher contribution limit for families.

Tax Benefits

The final notable difference is the tax benefits of these accounts. HSAs offer a triple tax benefit – contributions to HSAs are tax-deductible, growth within HSAs occurs tax-free, and withdrawals for qualified medical expenses remain entirely tax-free.

On the other hand, FSAs only allow pre-tax contributions, providing an upfront tax benefit, and tax-free withdrawals for qualified medical expenses. FSAs can’t be invested, therefore there is no potential for tax-deferred growth of your contributions, which is arguably the biggest benefit to a new attending physician.

Which is better?

There are situations where an FSA might be the better option, however, we find that for most of our young physician clients that the HSA tends to be the better option. The triple tax advantage of HSAs presents a benefit that is hard to match. The ability to invest HSA funds opens avenues for significant growth, potentially creating a robust financial cushion for future healthcare needs. The portability of HSAs allows physicians to carry their accounts from one job to another, fostering a seamless integration of healthcare savings into their evolving life plans. As physicians aim for financial security and flexibility, the unique benefits offered by HSAs make them a compelling choice, unlocking a path to both immediate relief and sustained financial well-being.

Panoramic Financial helps new attending physicians make the most of their new job’s benefits, including the use of HSAs and FSAs. Please click the “Work With Us” link at the top to learn more.

The foregoing content reflects the opinions of Panoramic Financial and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Panoramic Financial does not give tax or legal advice. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.