As a young attending, you have 20/20 vision into the cost of college. Perhaps you have 20/10 vision on education costs because you got to pay for both undergrad and med school. Many new attendings, as they start their new jobs, start focusing a new college cost: their children’s future educational expenses. A 529 account is a great starting point.

However, you now face high tax rates with your income, and you certainly don’t want to pay penalties or additional taxes on your kid’s college savings if you don’t have too. Using a 529 account offers you tax benefits on your kid’s college savings, but to take advantage of any tax benefit, you must use the savings on what are termed “qualified expenses.”

By design, 529 accounts are intended to be used as a saving tool for these qualified expenses. Just as a pulmonologist specializes in respiratory and lung-related disorders, a 529 account specializes in paying for tuition, books, and more college costs.

In this blog, we will share with you what does and doesn’t qualify for the use of your 529 savings. We will also provide alternative options for utilizing your 529 savings if your child pursues a path other than attending a qualified university. Being informed of the qualified, non-qualified, and alternative uses of 529 plans will help you avoid penalties, pay less taxes, and maximize your 529 savings.

What are qualifying expenses?

Defined by the IRS, “these are expenses required for the enrollment or attendance of the designated beneficiary at an eligible educational institution” (Publication 970, Ch 7). Essentially, qualified expenses are the required costs for your child to enroll and attend college.

“The importance of qualified expenses is they allow you to make use of the full tax benefits offered by a 529 plan. Any money withdrawn, including the growth, when used on qualified expenses is tax free.”

Eligible institutions are accredited colleges in the US and some international universities. If you know where your child may go to college, the US Department of Education has a searchable list of eligible university’s here. So, the ability to use a 529 account is an effective strategy if you think there is a strong likelihood that your child would attend an eligible institution.

To further be considered qualified, the expense and withdrawal from the 529 account must occur in the same year. You can’t pay out of pocket for college and then reimburse yourself from the 529 account in the following year, as that would effectively be a non-qualified expense.

Now fast forward to when your child is enrolled in college. You have a variety of expenses that you can pay for with the 529 account. Here is a list of qualified expenses:

- Tuition and fee payments to the institution.

- Books required for class participation.

- Supplies (Examples: computers, internet, computer software, lab materials, safety material, or any other material item required for a class.)

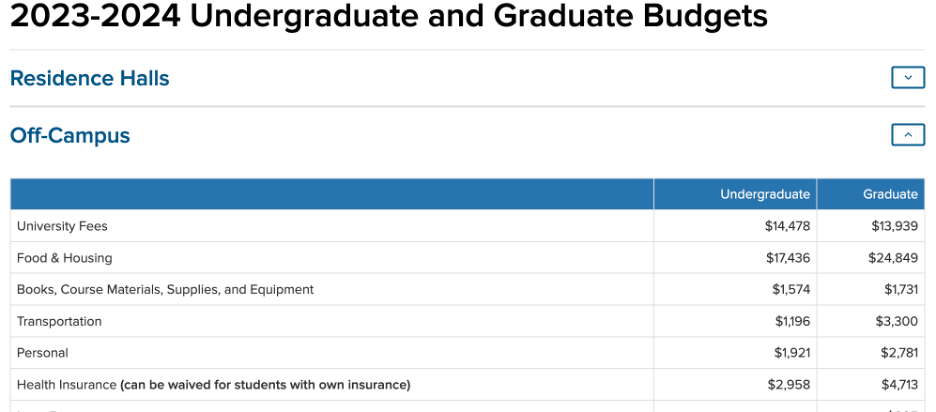

- Room & board (aka rent & food) – If a student is living off campus, the amount is limited to the college’s allotted amount for room & board. For example, UCLA’s 2023-2024 Undergrads living off-campus are allowed $17,436 for food & housing.

Here is an example of the budget granted to UCLA students for living off campus in the 2023 – 2024 academic year:

What doesn’t qualify?

While a payment may be made to an eligible college, not all expenses that occur can be deemed qualified. Here is a list of common expenses incurred in college that aren’t always qualifying expenses:

- Health insurance offered by the school. If the health insurance is required for attendance, then it may count as qualified.

- Cell phones or tablets

- College applications and testing fees

- Transportation or travel expenses – unless it’s required for enrollment and attendance

- Extracurricular activities – like clubs, athletics, or events

If a 529 account is used to pay for non-qualified expenses, you will incur a 10% penalty and pay taxes on the earnings. Some states may also impose an additional penalty and tax on the non-qualified withdrawal. Because you are likely going to be in your highest earning years when you use the money in the 529 account, it’s very important to avoid non-qualified expenses.

Additional flexibility

Suppose that when your child reaches early adulthood and for one reason or another, they decide not to attend a qualified institution. What do you do with the money that you have invested in your 529 account? Here are some alternative uses that won’t incur penalties but may involve taxes. You can:

Transfer to Roth IRA

This is really just a benefit for the designated beneficiary. But if correctly planned for, savings from a 529 account can be transferred to your child’s Roth IRA. We have additional context on this strategy here. In short, you may be able to transfer 529 savings, penalty free and tax free, into your kid’s Roth IRA.

Reassigning the 529 account to another family member

For example: you have saved for your oldest to go to Harvard, but instead they chose UC Irvine. You have money left over after the oldest has graduated, but your youngest kid decides they’d like to pursue grad school. You can reassign the 529 account to have the youngest kid as the beneficiary and continue to pay for qualified expenses for the youngest. Reassigning 529 account beneficiaries to another family member will not incur taxes or penalties, if done correctly.

Scholarship Exception

It’s hard to know the college plans of a toddler, let alone forecast whether they will receive a scholarship for college. For that reason, if your child receives a scholarship, you can withdraw a matching amount of the scholarship, for any reason, from the 529 account, and not incur a penalty. However, you will still pay taxes on the gains of the withdrawal.

Trade schools

Some trade schools are a part of eligible education institutions. You can check for eligible education institutions here. Trade school would also be a qualified expense, and allowable to be paid for tax free and penalty free.

K-12 schooling

Some states allow you to withdraw from your 529 account to pay for K-12 expenses. The annual withdrawal for K-12 schools is limited to $10k/year. However, some states don’t consider K-12 a qualified expense. For example, if you live in California and you withdraw 529 savings for K-12 expenses, you can expect a state penalty of 2.5% on the earnings because California doesn’t consider K-12 a qualified expense. While that may not be a big penalty, you’re most likely better off paying for K-12 from another type of account.

Pay down your student loans

This would be a two-step process if the 529 account has your child designated as the beneficiary. Because the 529 account can only be used for the listed beneficiary you would first transfer your kids 529 account to list you as the beneficiary. Once you’re assigned as the beneficiary you can use the 529 to pay down student loans, penalty free and tax free. However, the lifetime amount allowed to pay down student loans is $10,000.

Considering that college is a long distance down the road and the costs are uncertain, using a 529 account is a great starting point for your college savings strategy. It helps to know that there are alternative uses too if you end up saving more than your child needs for college.

At Panoramic Financial Advice, we help our clients plan and save for their kids’ education goals. If you’d like to schedule a complimentary consultation, please click “Work With Us” at the top.

The foregoing content reflects the opinions of Panoramic Financial and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Panoramic Financial does not give tax or legal advice. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.